MAIA Biotechnology

MAIA Biotechnology publishes preclinical data on cancer drug candidates

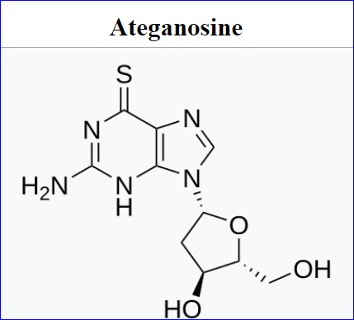

CHICAGO - MAIA Biotechnology, Inc. , a clinical-stage biotech company with a market capitalization of $51.8 million, announced the publication of preclinical data from its second-generation ateganosine prodrugs platform in the scientific journal Nucleic Acids Research on June 26, 2025. The announcement comes as the stock has experienced an 11.4% decline over the past week, according to InvestingPro data.

The study, titled "Novel Telomere-Targeting Dual-Pharmacophore Dinucleotide Prodrugs for Anticancer Therapy," details the company’s research on telomere-targeting compounds designed to treat cancer. While the company maintains a healthy liquidity position with a current ratio of 2.35 and more cash than debt on its balance sheet, InvestingPro analysis indicates the company is not yet profitable, with analysts forecasting continued losses for 2025.

According to the published research, MAIA’s lead compounds MAIA-2021-20 and MAIA-2022-12 demonstrated anticancer efficacy in laboratory studies. The data showed that combining these compounds with immune checkpoint inhibitors resulted in lower inhibitory concentration compared to using either treatment alone.

The company has developed more than 80 ateganosine-like compounds as part of its telomere targeting program. In January 2023, MAIA nominated MAIA-2021-20 as its lead candidate and MAIA-2022-12 as a backup candidate for advancement into preclinical toxicity studies.

MAIA’s first-generation compound, ateganosine (THIO), is currently in clinical development for non-small cell lung cancer. The drug is designed to target telomeres, which play a role in cancer cell survival and resistance to therapies.

The company is working to advance at least one of its second-generation candidates into human clinical trials following completion of required toxicity evaluations, according to the press release statement.

MAIA Biotechnology describes itself as a targeted therapy, immuno-oncology company focused on developing potential first-in-class drugs with novel mechanisms of action for cancer treatment. Despite recent stock pressure, analyst price targets range from $10.27 to $14.00, suggesting significant potential upside.

In other recent news, MAIA Biotechnology has reported that the first patient in Taiwan has been dosed in the expansion phase of its THIO-101 Phase 2 trial for advanced non-small cell lung cancer (NSCLC). The company highlighted a median overall survival of 17.8 months among 22 patients, which is promising compared to standard chemotherapy treatments.

Additionally, MAIA Biotechnology has entered a stock purchase agreement with Prevail Partners, allowing for the issuance and sale of up to $587,905 in common stock. The proceeds will fund technologies and services for a Phase 3 study of ateganosine in NSCLC. In another development, MAIA has appointed two hepatocellular carcinoma experts to its Scientific Advisory Board as they prepare for a trial involving ateganosine in HCC patients.

Furthermore, MAIA has partnered with Roche to explore combining ateganosine with Roche’s atezolizumab in treating multiple cancers. Lastly, a partial response was observed in a patient from the Phase 2 THIO-101 trial, with a tumor size reduction of at least 30%, indicating potential efficacy in third-line NSCLC treatment.