Vertex Pharmaceutical Stock Dives as Firm to Stop Developing Acute Pain Drug

Shares of Vertex Pharmaceuticals sank 15% soon after the opening bell Tuesday, Aug. 5, 2025. Vertex Pharmaceuticals reported a Phase 2 trial of its experimental pain treatment missed key endpoints. Because of the results, the drugmaker will no longer develop the medicine, called VX-993.

The news sent shares tumbling despite Vertex reporting strong quarterly earnings. Shares of Vertex Pharmaceuticals (VRTX) sank 15% Tuesday, a day after the drugmaker announced a study showed its experimental pain medicine was not successful, and it would no longer move forward with its development.

The company said a Phase 2 trial of VX-993 "did not result in a statistically significant improvement on the primary endpoint of the time-weighted Sum of the Pain Intensity Difference from 0 to 48 hours (SPID48) compared to placebo."

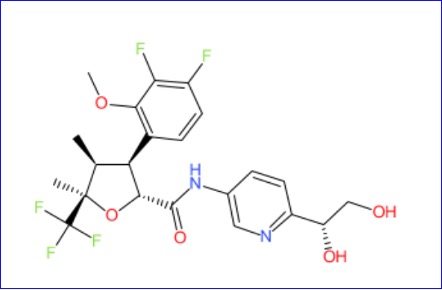

Chief Medical Officer Dr. Carmen Bozic explained that the findings, along with other data on VX-993, indicated that the treatment was not expected to be superior to Vertex's other NaV1.8 inhibitors, so "we will not be advancing it as monotherapy in acute pain." The company was testing VX-993 as a follow-up to its NaV1.8 inhibitor drug, Journavx, which received Food and Drug Administration (FDA) approval in January.

The news offset Vertex's better-than-expected second-quarter results. The company posted adjusted earnings per share of $4.52, with revenue rising 12% year-over-year to $2.96 billion.

Both exceeded estimates of analysts surveyed by Visible Alpha. Most of its sales ($2.55 billion) came from its Cystic Fibrosis treatment known in the U.S. as Trikafta. With today's big selloff, Vertex Pharmaceutical shares hovered around break-even year-to-date.