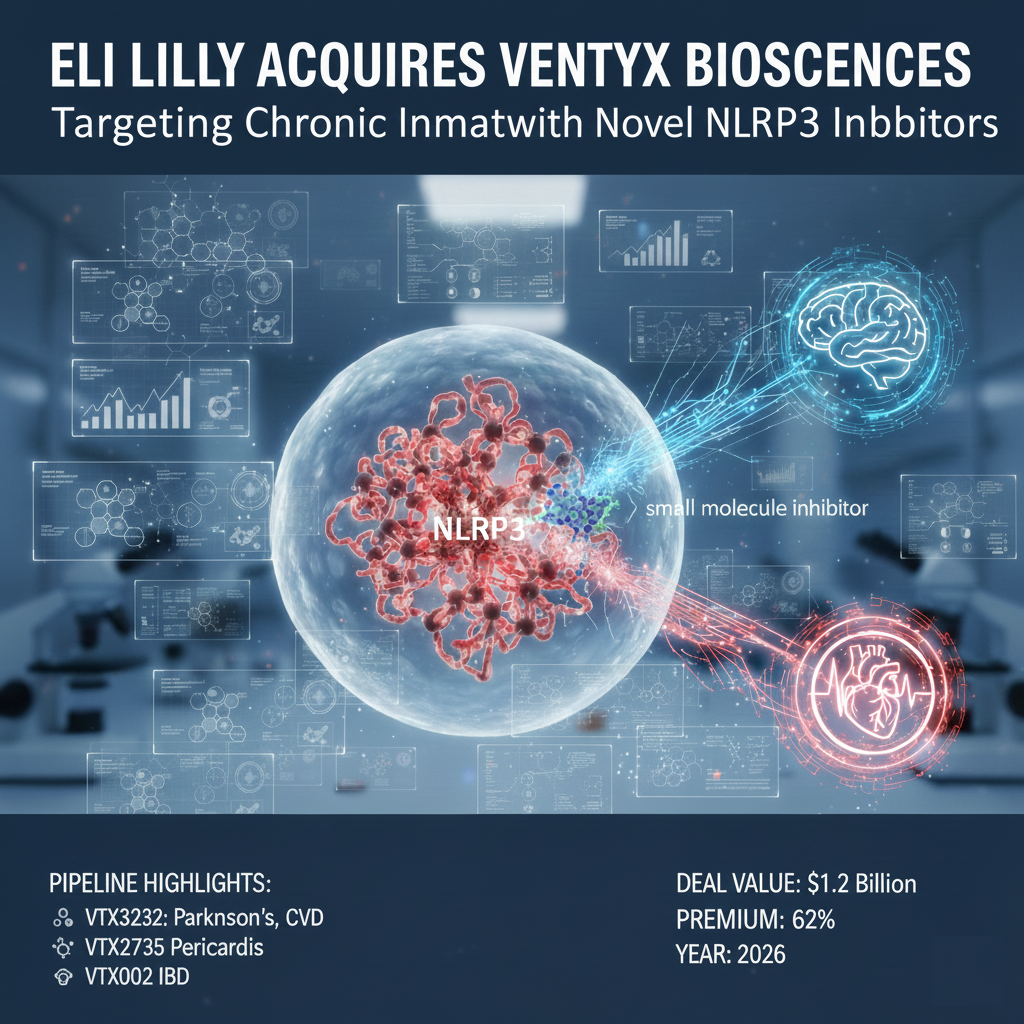

Eli Lilly Completes $1.2 Billion Strategic Acquisition of Inflammation Specialist Ventyx Biosciences

In a decisive move to expand its footprint in the immunology sector, Eli Lilly and Company has officially entered into an agreement to acquire Ventyx Biosciences. This $1.2 billion transaction marks Lilly’s inaugural M&A activity for 2026, signaling a robust effort to diversify its therapeutic portfolio beyond its dominant and highly successful diabetes and obesity franchises.

Under the terms of the agreement, Lilly will purchase all outstanding shares of Ventyx for $14.00 per share in cash. This represents an aggregate equity value of approximately $1.2 billion and reflects a substantial 62% premium over the 30-day volume-weighted average price of Ventyx’s common stock as of January 5.

Ventyx Biosciences has distinguished itself as a leader in the development of small molecule therapeutics targeting the innate immune system. At the center of this acquisition is Ventyx’s expertise in NLRP3 (NOD-like receptor pyrin domain-containing 3) inhibitors.

The NLRP3 protein is a critical component of the immune system that, when overactivated, triggers chronic inflammatory pathways. Research has increasingly linked NLRP3 dysfunction to a wide spectrum of high-burden conditions, ranging from neurodegenerative diseases like Parkinson’s to complex cardiometabolic and cardiovascular disorders. William Blair analyst Myles Minter noted that this acquisition underscores Big Pharma's accelerating interest in the NLRP3 class as a versatile platform for multi-indication therapy.

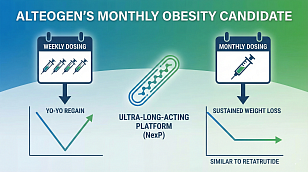

This acquisition comes at a time of unprecedented growth for Lilly, largely fueled by its GLP-1 blockbuster Zepbound (tirzepatide), which saw a 185% sales increase in Q3 2025. Despite this success, Lilly is reinvesting its capital to build a resilient, multi-pillar pipeline. The Ventyx deal follows a series of high-value investments in pain management, oncology, and gene therapy.

| Recent Lilly Acquisitions | Value | Therapeutic Focus |

|---|---|---|

| Ventyx Biosciences | $1.2B | NLRP3 / Autoimmunity |

| Scorpion Therapeutics (Asset) | $2.5B | Oncology / Precision Medicine |

| Rznomics | $1.3B | RNA-based Gene Therapy |

| SiteOne Therapeutics | $1.0B | Non-opioid Pain Specialty |

For organizations like ChemDiv and other global R&D infrastructure providers, Eli Lilly's pivot toward NLRP3 inhibitors validates the long-term potential of small molecule drug discovery in complex immunology. The transition from "reactive" treatment to "modulating" innate immunity represents a significant shift in how the industry approaches chronic systemic inflammation.

The transaction is expected to close in early 2026, subject to customary closing conditions and regulatory approvals, setting the stage for Lilly to lead the next generation of anti-inflammatory precision medicine.

This acquisition positions Eli Lilly at the forefront of the "post-obesity" therapeutic landscape, where the focus on systemic chronic inflammation will likely define the next decade of medical breakthroughs.