Innovation on hold during the pandemic? FDA says no with 29 approvals in first half of 2021

Many pursuits have been put on hold during the coronavirus pandemic. But biopharmaceutical innovation isn’t one of them. In 2020, the FDA approved 53 new drugs, the second-most in a single year, after 2018’s bounty of 59.

And the momentum has continued through the first half of 2021. With the FDA endorsing its 29th novel drug on June 30, the industry was slightly ahead of last year’s pace.

No. 29 came last week with a green light to Jazz Pharmaceuticals for its blood cancer therapy Rylaze. It was the first FDA approval in 23 days.

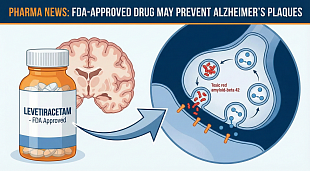

Perhaps the U.S. regulator needed a break after the uproar that ensued after its June 7 nod for Biogen’s Alzheimer’s disease treatment Aduhelm. It was an approval so divisive that three members of the FDA’s advisory committee that reviewed the drug quit in protest. In his resignation letter to acting FDA commissioner Janet Woodcock, Harvard Medical School professor Aaron Kesselheim called the move a “debacle” and “probably the worst drug approval decision in recent U.S. history.”

Within hours of its green light, Biogen ignited another firestorm when it revealed the treatment’s annual price tag of $56,000 and provided a new flashpoint for the decades-old drug-pricing debate.

Before the Aduhelm controversy eclipsed everything else, the year had featured a lot of other high-profile approvals. GlaxoSmithKline and ViiV Healthcare earned a nod for Cabenuva, a long-awaited monthly injectable for those with HIV. ADC Therapeutics won a green light for Zynlonta, the first single-agent CD19-targeted antibody-drug conjugate for diffuse large B-cell lymphoma. And Apellis scored with Empaveli for the rare, chronic blood disorder paroxysmal nocturnal hemoglobinuria (PNH).

Another high-profile approval came in late May for Amgen's new cancer drug Lumakras. The non-small cell lung cancer treatment has been highly anticipated, as it targets KRAS mutations which were previously believed to be “undruggable.”

The green light for Lumakras triggered a Memorial Day weekend splurge for the FDA. On the same Friday afternoon, Alkermes’ schizophrenia drug Lybalvi and BridgeBio’s bile duct cancer therapy Truseltiq also won approvals. Then the Tuesday after the holiday, Scynexis gained an FDA nod for its potential blockbuster Brexafemme, the first new treatment for vaginal yeast infection in more than two decades.

The approval for Truseltiq was particularly noteworthy because it was the second this year for tiny BridgeBio, which reported $8.2 million in revenue last year.

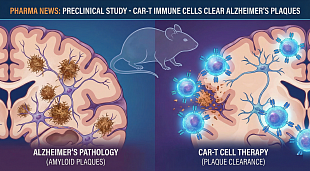

The only other firms with two approvals in the first half are companies on the other end of the industry spectrum. Pharma giant Johnson & Johnson earned nods for NSCLC antibody Rybrevant and multiple sclerosis therapy Ponvory. Bristol Myers Squibb scored two CAR-T approvals, as well.

In terms of treatment areas, it is of little surprise that oncology accounts for 12 of this year’s approvals. That figure represents 44% of all new drug approvals this year, an even higher rate than in 2020 when 20 of 53 new drugs were in the oncology class.

Even during a pandemic, don’t expect the pace of innovation to subside. It’s a sign of the times, and successes will only fuel further innovation, according to Ernst & Young industry analyst, Arda Ural.

“The acceleration in the successful development of truly novel platform technologies and therapeutics offers the opportunity for higher returns on investment and are driving pipeline priorities,” Ural wrote in his analysis of first-quarter trends this year. “Gene therapy, mRNA vaccines and therapeutics, cell therapy and gene editing once seemed like science fiction but now are a reality.”

Jul 6, 2021

https://www.fiercepharma.com/