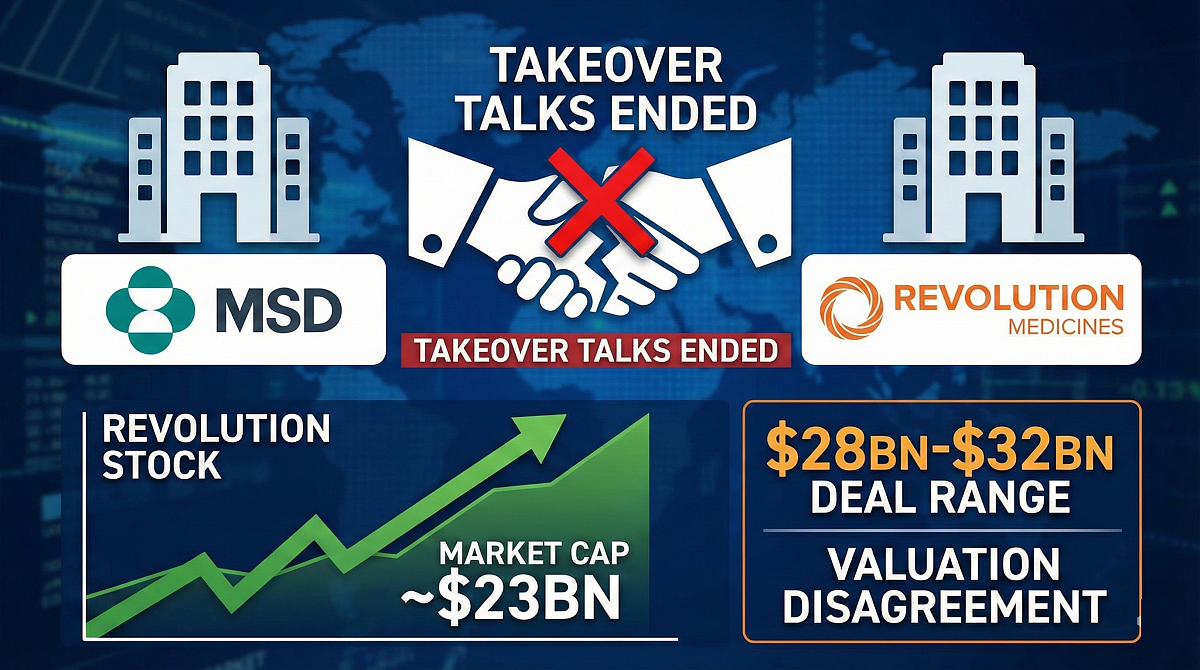

MSD Ends Takeover Talks with Revolution Medicines

- Revolution Market Cap: ~$23bn

- MSD Deal Range: $28bn - $32bn

- Biotech Stock Trend: +65% vs Jan 2025

- Global M&A (2025): $240bn (+81%)

Merck & Co (MSD) is no longer in talks to acquire oncology biotech Revolution Medicines after negotiations hit a stumbling block over valuations, according to the Wall Street Journal (WSJ). The two companies reportedy could not agree on a price, leaving pharma’s first potential megadeal of 2026 on ice.

Citing people familiar with the matter, the WSJ said that the two companies could not agree on a price. MSD had been looking to complete a deal in the $28bn-$32bn range, according to a Financial Times (FT) report from 12 January.

Negotiation Timeline: JP Morgan Healthcare Conference

Talks over a potential deal for Revolution dominated the build-up to the 2026 JP Morgan Healthcare Conference. Despite MSD and Revolution not aligning so far, talks could restart or continue with another party, should a suitor show acquisition interest.

- 7 January: WSJ reported AbbVie was in advanced talks to acquire Revolution in a deal worth more than $20bn. An AbbVie spokesperson later confirmed to Pharmaceutical Technology that the company was not in talks.

- 8 January: The FT reported that MSD was mulling an acquisition.

Revolution’s Portfolio: Oncology Assets

Revolution’s most advanced asset is daraxonrasib, a pan-RAS inhibitor taken orally. The drug is in Phase III studies for pancreatic cancer and non-small cell lung cancer (NSCLC) as a monotherapy. With a market cap of around $23bn, the company has seen its stock climb over the last year on the back of its promising oncology portfolio, boosted even further this month by the rumoured takeover talks.

Global M&A Landscape and Outlook

If a deal were to fall between the $28bn and $32bn goalposts, it would mark the biggest M&A in healthcare since Pfizer acquired cancer biotech Seagen for $43bn in December 2023. Observers will be closely watching if talks resume between a suitor and Revolution in the coming months.

As per a report by EY, global life sciences M&A investment totalled $240bn in 2025, an 81% increase from $130bn in 2024. Many major drugmakers are facing patent expirations for blockbuster products, leading to increased dealmaking.

— Subin Baral, EY LifeSciences Global Deals Leader (December 2025)